But, what if you want to work for an early stage startup?

Pre-seed or small seed round businesses do not advertise in the same places as other larger companies, and some not at all - they may want staff, or need them, but have not yet expanded past a small technical team that don’t have the knowledge on how to approach talent or even begin to start building an ATS or internal CRM.

Finding these companies and reaching out to them at pivotal growth stages is a skill in itself. These companies value people generally who are able to turn their hands to multiple areas of business, whether that be;

Business development AND marketing

or

Marketing strategy and Individual contributor skills for SEO optimisation, Content scheduling and posting, understanding tone of voice, ability to build communities on multiple social platforms etc

or

Being a competent general operations person who can improve processes but has the financial knowledge to deal with finance and invoicing in addition to these skills etc.

or

Any other combination of general business skills.

First, you have to understand where to find them.

Finding.

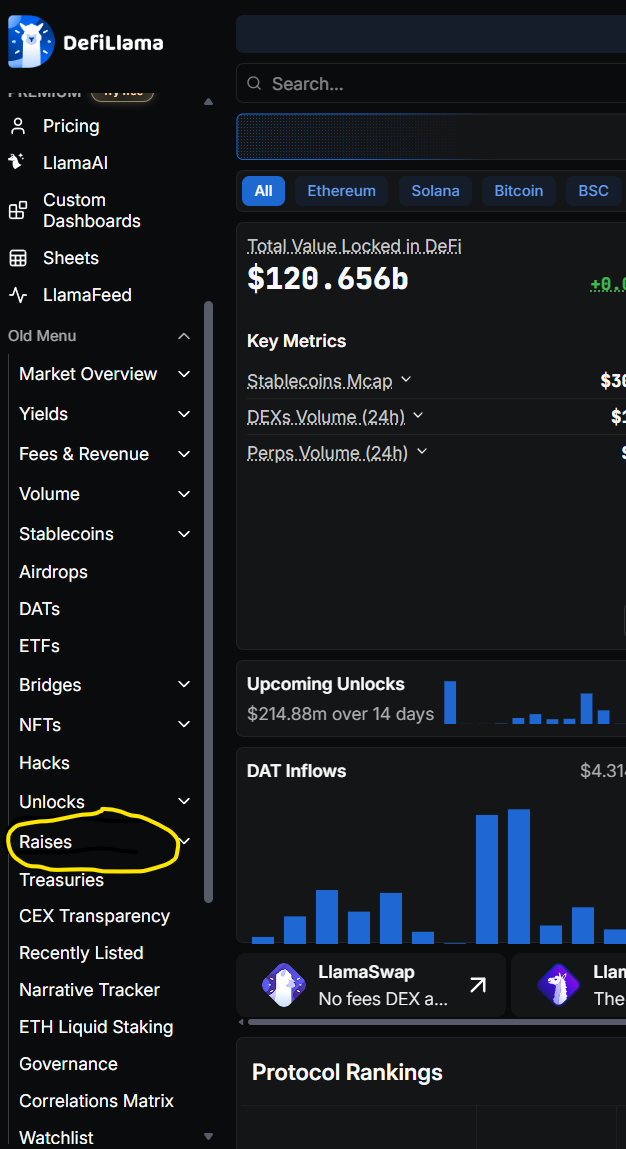

There are many sites that track “recent crypto project raises” - defilama.com is one such resource you can use to find relevant early stage start ups.

Defilama is a data dashboard that tracks many things, but what we are looking for is the “Raises” (in the old menu) > Overview selection.

Filtering.

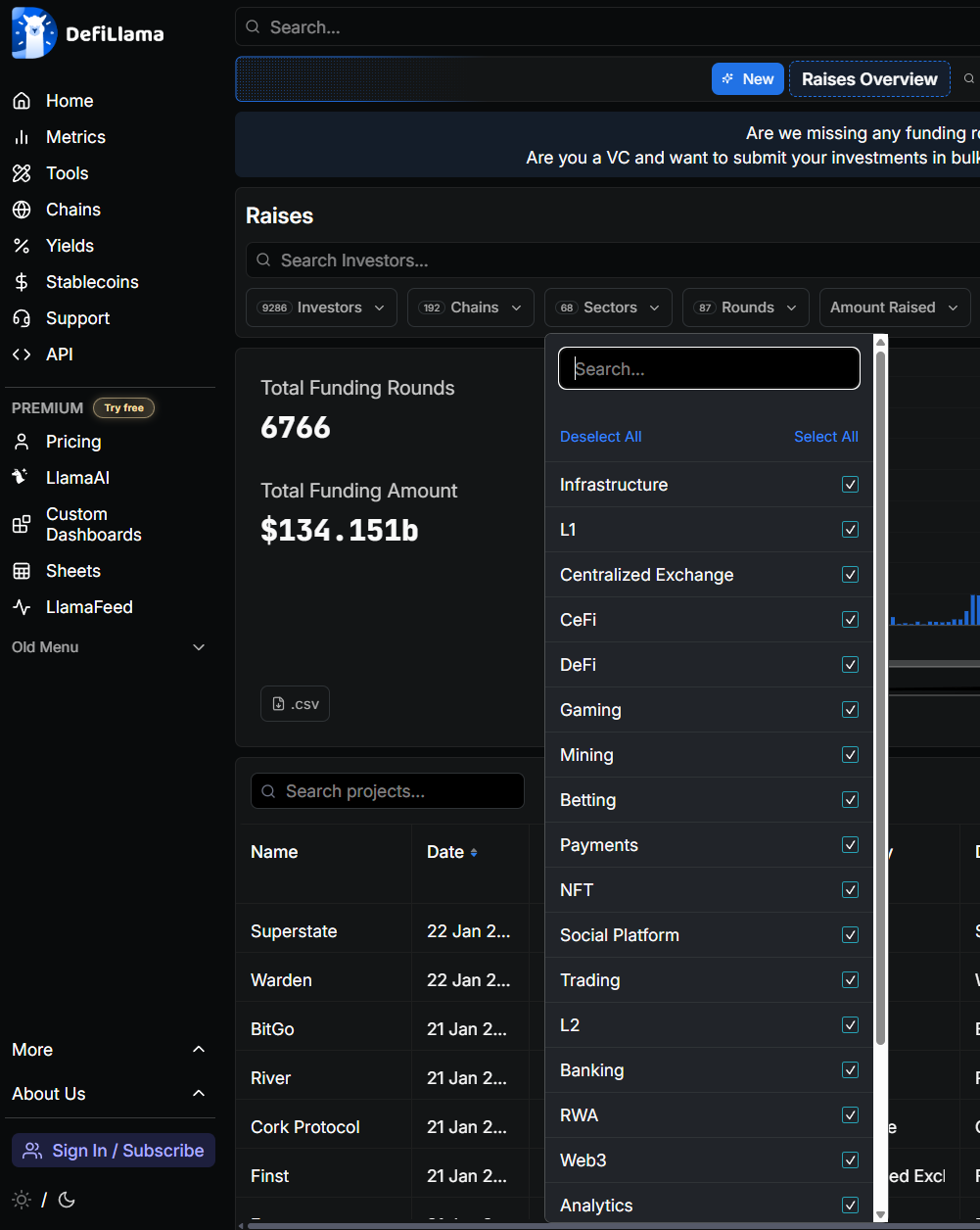

Now you can see the data for all projects that have recently raised, how much they raised and how long ago.

Filter by sector, and select a sector you’d like to look at working in, or already have prior experience in

Defi/NFT/iGaming/Infrastructure etc

AND

By Funding Round - we’re looking for Seed, Pre-seed, Angel Round, Grants etc.

Analysing the results

In the above example, we have selected all RWA projects and early stage funding rounds to review.

Now we can determine which companies that have recently raised and are likely to potentially expand staffing in the near future.

Take a look, anything over $3m-$5m generally will sustain runway for more than 1-2 years depending on how much they spend (aka internal burn rate), so you can be certain that if you are able to contact them and join there is some runway costs for salaries.

What to do with this new information

Contacting.

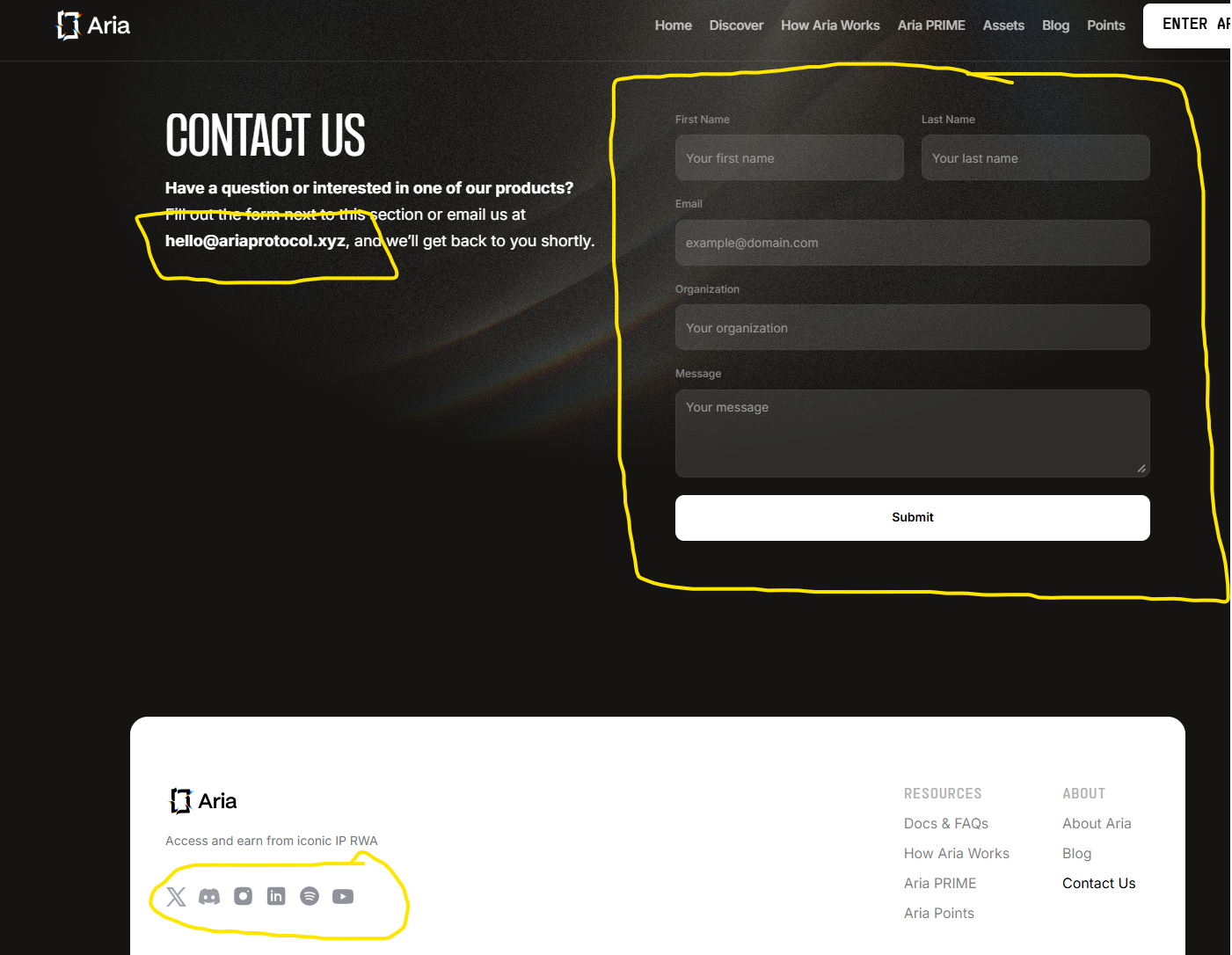

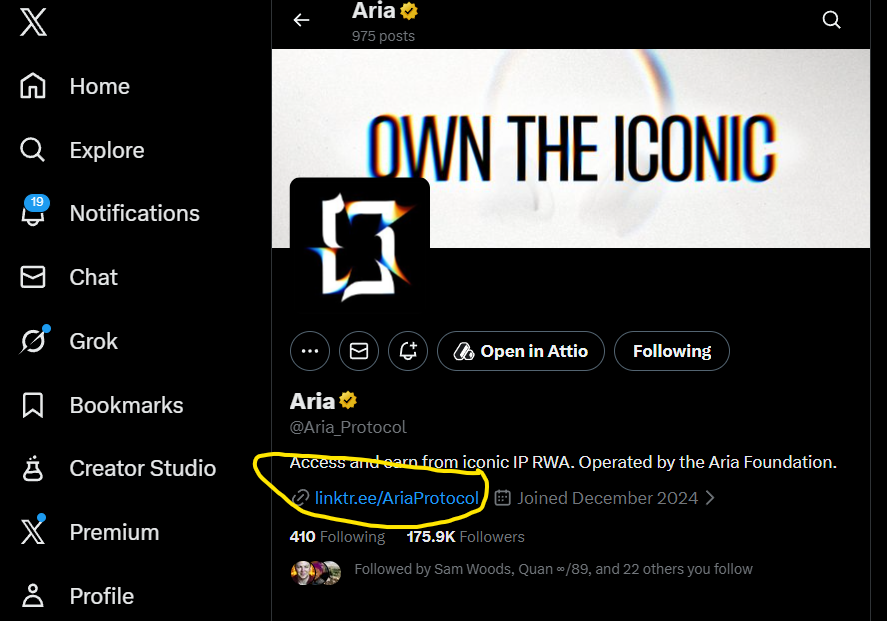

We’ll use Aria as an example from the last screenshot.

Some of the companies listed will have a LinkedIn page, and some won’t. Google them first, in this instance we see a contact form, social links to Linkedin, X and Discord as well as some others.

LinkedIn is a good start. Go find the company on LinkedIn and message some of the team/connect congratulating them on the recent raise along with a CV/resume saying that if they are planning to expand you’d love to be considered

This shows awareness of the market, their product and your ability to find and create opportunities.

No Linkedin? No problem.

Head on over to X (formerly known as twitter) and search for the project, most crypto native builders live on X.

They’re not on X?

No problem, if they have a telegram group, you can inspect the groups sometimes for Admin roles- be careful of scam copycat groups though.

Not on Telegram?

Do they have a website with a generic contact email or form?

If they have raised money, often they will already have a basic landing page with contact information for potential investors to contact them.

No website?

Well, maybe they have a discord - if you can find this, you can ask in the general forums in their discord if they’re hiring new staff and if they’re attentive you may get a reply there.

How to position yourself for success

Do your research! Understand the business from their socials, their blog posts, their news articles posted on their X feed.

Highlight how your experience in previous roles feels like you can help them make a difference in their next stages of growth and give examples of where you’ve done this before.

Early stage companies need strategic thinkers AND executers (or individual contributors) at this early stage to maximise the value of the budget and raised money.

You might not get the base you want to earn in other big businesses but if you are someone who likes to own equity or early stage team tokens and are confident you can help them to grow, then your reward for helping them do that can be enormous on future company success.